Who are Forex brokers?

Who are Forex brokers, and what role do they play in trading the foreign exchange market?

With the development of modern Internet communications, Forex trading has become available for most private traders and investors. Previously, only a select few (large corporations, banks or owners of huge fortunes) could trade in the foreign exchange markets, but now almost everyone can afford Forex trading. To do this, you do not need to make huge investments, it is enough to have $ 500 – $ 1,000 on your account for comfortable trading. To access the foreign exchange markets, you need to open an account with a Forex broker who is an intermediary between you and the foreign exchange market. Before you start trading on Forex, you need to understand who Forex brokers are and what they are for.

What are Forex brokers?

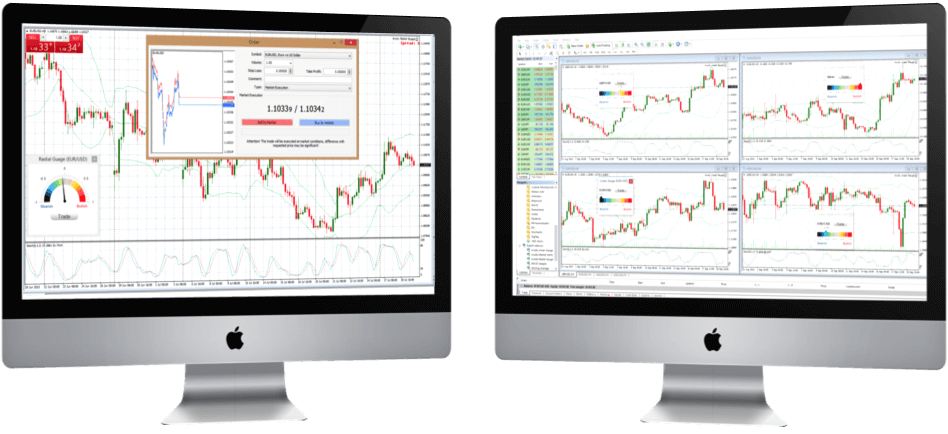

So, Forex brokers are individuals or legal entities that act as an intermediary between a trader and the foreign exchange market. According to the law, a private person cannot directly conclude sales transactions on the currency exchange. All trading operations must be carried out directly through a Forex broker or, as it is also called, a dealing center, the activity of which is carried out on the basis of licenses and is regulated by various state bodies and public organizations. To start trading, you need to register on the broker’s website, open an account and replenish it using a plastic card or electronic wallet. Access to the foreign exchange market is carried out through the trading platform, which can be downloaded on the website of the dealing center. Forex brokers use various platforms, but MetaTrader 4 is considered the most popular of them. With its help you can make trading operations, develop your own strategies, conduct graphical analysis, use technical indicators and automated trading systems in trading.

What additional functions does the Forex broker carry out?

In addition to conducting trading operations, as well as providing trading tools such as currency pairs, precious metals and CFD contracts, the best Forex brokers also provide the following functions:

– economic news feed;

– calendar of important economic events;

– Fresh forecasts from leading analysts;

– Useful information for novice traders;

– free indicators and advisers.

How do brokers earn?

We cannot but touch upon such an important topic as the earnings of brokers. Forex brokers charge a commission in the form of a spread for the provision of intermediary services to provide access to foreign exchange markets. Each time you open a new deal, you will see how the spread is automatically added to it, which can be floating (from 0.1 points) or fixed (2-3 points). You can get more detailed information in the specifications of the contracts with your broker. Many brokers reduce the spread by attracting new customers, which is extremely beneficial for private traders.

On the market you can find various models of brokerage companies:

“Kitchens.” Such companies include dealing centers or market makers who earn not so much on the spread as on the deposits of their customers. “Kitchens” do not access the interbank foreign exchange market, as reliable brokers do, so the money of all traders remains inside the company. In this case, the trader’s profitable trade turns into losses for the dealing center. In this case, market makers do everything possible to “survive” a profitable trader from their company: they worsen the execution of orders, replace market quotes with their own, delay the withdrawal of funds or refuse to pay at all;

Brokers and banks. The main difference between brokers and dealing centers is that they instantly withdraw transactions to the interbank market through liquidity providers, which include investment funds, banks and larger brokers. As a result, the trader receives the following benefits:

– orders are executed at high speed without requotes;

– slippages can be both unprofitable and profitable;

– the trader gets the best price and minimum spread;

– full anonymity is observed during trading operations;

– a trader can see his and other orders in a glass of applications.

Since reliable brokers are only intermediaries between traders and liquidity providers, profitable transactions of traders are not losses of the company, therefore, the broker does not conflict with them and quickly displays the earned profit. On the contrary, the more a trader opens transactions, the more the broker will earn regardless of the profitability or loss-making of completed trading operations. There are also brokers with a banking license. Despite the more stringent requirements for the minimum deposit and withdrawal methods, banks can be attributed to the most reliable and trusted brokerage companies.

Instead of spread, some brokers may charge a fixed commission for the total volume of transactions. This can be very convenient for those traders who open a large number of transactions per day.