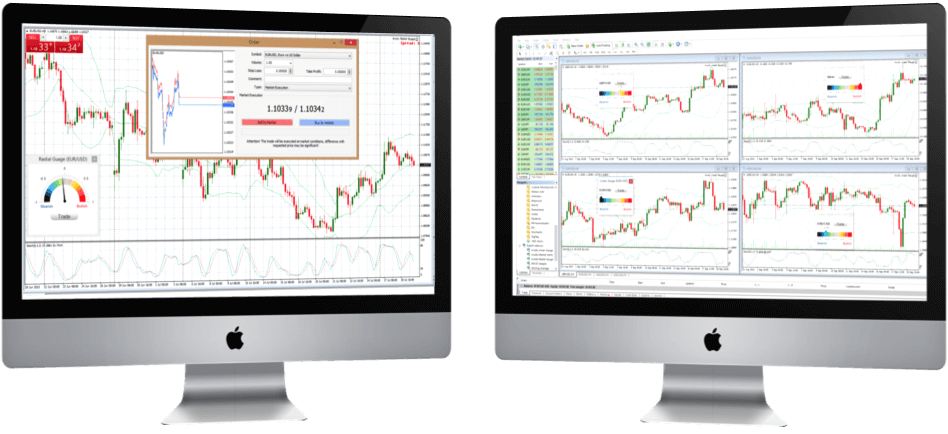

What is a white label for forex brokers?

Each company in the Forex market tries to maximize its income with the help of additional services, and each new company in this market tries to save time on its opening. White label (hereinafter – WL) is the only case when the interests of both parties are closer than ever, since this cooperation promises both parties benefits. Time is the most valuable for a person and most importantly for any financial company that is associated with the provision of services. The Forex market with all its negative and positive sides remains the most dynamic, which makes its inhabitants need to quickly respond to changes and offers. Therefore, many brokers begin their journey with a White label from a licensed company.

The WL system is approved by all regulators and even encouraged by them. In particular, the FCA has recently focused on those applicants (the applicant is a license holder from the FCA) who have already worked as a broker through WL in British jurisdiction. Therefore, this system of work not only saves time for creating a company, but also significantly increases the chances of the regulator when submitting documents for his license.

Who needs a while label?

White label is necessary for those forex companies that are not ready to wait 9-12 months to receive their license from FCA, as well as those who have not worked in the British jurisdiction as a forex broker. The costs of setting up a company and obtaining a White label are comparable to the costs of an offshore company. However, within WL, the company will not be able to use traditional investment services.

The parent company providing WL has a double risk, because in case of violation of the FCA rules by the subsidiary, it risks losing the license. In this case, the supervisor of the United Kingdom (FCA) did everything very competently, shifting the responsibility for supervision to the parent companies, which makes this type of business very “intimate”. Such a regulator policy creates an excellent balance in the system for the supervision of brokers.

Due to the great risk for themselves, parent companies providing WL status request all information about the alleged owners of the future business. Therefore, everyone who wants to get WL needs to be prepared immediately to provide all data on the origin of capital, etc. They should also be prepared that all financial flows will be controlled by the parent company. Therefore, subsidiaries after the first quarter of work submit documents for their license. On average, a WL contract is concluded for 15 months or until the daughter receives her FCA license.

White label pros

the company can start work in just 4 months

a simplified procedure for obtaining an Appointed representative, compared with the fund *

* Note: AR status is obtained automatically after signing the WL contract

the company that received WL has a smaller staff, since many functions are performed by the parent company

the parent company provides a risk management service and b-book, which increases the subsidiary’s income

quick staff training

the possibility, after several months from the moment of receiving WL (as well as AR status), to apply for your FCA license

WhiteLabelsFX does not require any supporting documents from its customers, does not use fees and restrictions!