How Forex brokers work: interaction with clients. What is Forex and who are Forex brokers?

The work of brokers on the Forex currency exchange

There are a large number of different “players” on the Forex market, including brokers, clients, traders, investors, attraction agents, pr-managers and many others.

The main players in the Forex market are clients. It is for the sake of clients and receiving their commissions from them that all brokerage companies, partners and asset managers work. For more information on how brokers interact with their clients, read the information below.

What is Forex

Forex is a place of currency exchange between participants. Literally Forex is translated from two abbreviated English words Foreign Exchange as foreign exchange.

The Forex market is intended for carrying out currency exchange operations between its participants who need one or another foreign currency for their own purposes.

This foreign exchange market is most important for banks that serve clients in the field of import / export to provide them with foreign exchange funds for the purchase / sale of goods in foreign countries.

Who are Forex brokers

In the Forex currency market, it will not work to buy or sell the currency itself, since an intermediary between the buyer and seller of a certain currency is needed to carry out a currency exchange operation. Such intermediaries are Forex brokers.

The essence of Forex brokers is that clients open accounts for them, who can simultaneously be both sellers of currency and its buyers. The Forex broker acts as the guarantor of the execution of the exchange operation between buyers and sellers, for which it takes its own commission.

How does a Forex broker work

All brokers in the foreign exchange market can be divided into several categories.

Forex broker categories:

Prime brokers – withdrawing all transactions to the interbank foreign exchange

Brokers who withdraw part of the transactions to the interbank market.

Kitchens – transactions take place inside brokers and transactions are not displayed on the interbank market.

Prime Brokers are world-class liquidity providers. Prime brokers include such banks as: Deutsche Bank, Bank of America, Morgan Stanley, JPMorgan Chase, Barclays Capital, Citi and others.

Prime brokers can work with both traders and brokers. But the main difference between prime brokers and other brokerage companies: rather high margin requirements, as well as the size of the initial deposit, which may not reach from several tens of thousands of US dollars to several tens of millions.

Brokers who transfer part of the transactions to interbank exchange operations, overlap the transactions of some clients (villages, sales), transactions of others (buy, purchases). If there is more of one type of transactions than another, then the broker transfers the difference to prime brokers or other liquidity providers.

These brokers provide a completely transparent cooperation scheme and such brokers can be called gray brokers.

Forex kitchens are brokerage companies that do not display traders’ transactions on the interbank market, but overlap the transactions of some clients (villages, sales), transactions of others (buy, purchases), while if one type of transaction is more than another, the broker opens transactions against the client … In such a scheme, each client’s winnings draws money from the pocket of the brokerage company. And each loss of the client replenishes the broker’s pocket.

Forex execution

Having registered a trading account with a brokerage company, the client, immediately after replenishing his account, can start currency exchange operations or choose where to invest money on the Internet at Forex.

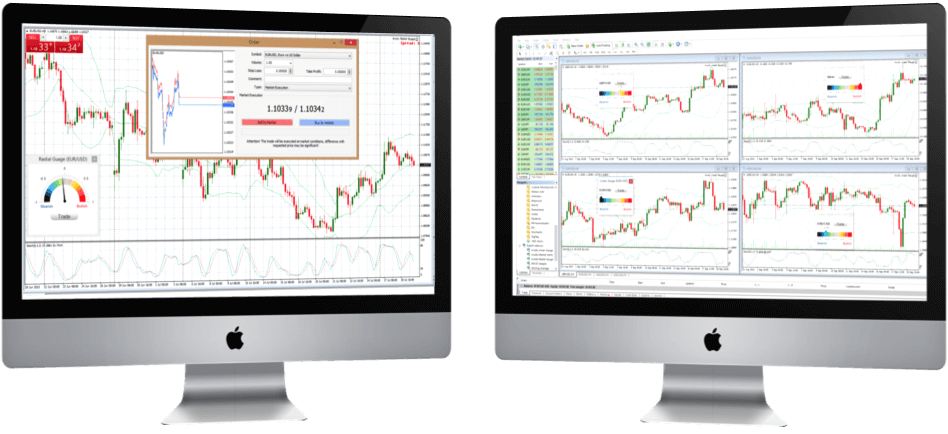

In most cases, brokers offer their clients to use the developed trading applications – MT4 and MT5 terminals, web platforms, mobile applications and, of course, telephone dealing (it was from this that the first remote exchange operations began).

Do you need Forex and can you make money on it?

People who have lost money in the foreign exchange markets or who are not familiar with it at all believe that Forex is a scam and deception. But this is only their opinion, as victims who did not realize the possible trade and non-trade financial risks.

The Forex currency market is very important and necessary for interaction and carrying out export-import operations between all countries of the world, for hedging risks, for investing in foreign world currencies.

Conclusion

The work of Forex brokers in the foreign exchange and other financial markets is important for interaction between different countries, by buying / selling the required currency for financial transactions, concluding contracts and agreements for the supply of goods / services, etc., between these countries.

This concludes our article on how Forex brokers work in the financial markets. We wish you all good luck and high earnings! The fastest way to become a forex broker is white label for mt4 or mt5