How to open a broker on the Forex market yourself? How much does Metatrader 4 or Metatrader 5 cost?

So, the first stage is to work out the idea itself, the business plan.

As a rule, a broker is created by people who have a good understanding of the market itself, the principles of its operation, most likely they themselves have rich experience in trading, and they well understand how both the broker and the client make money. Therefore, it will not be difficult for them to compile a list of tasks, the solution of which will lead to the goal, namely:

– Where to get the price stream for the execution of clients’ transactions?

– What trading platform will be provided to clients?

– Which jurisdiction to choose for work and in which bank to open an account for the company?

– What payment systems will be used to deposit and withdraw customer funds?

– What trading conditions should you give to clients?

– How to set up a trade flow, commissions?

– How to attract clients?

Let’s start in order.

Where can I get prices?

On the one hand, there are a lot of sources of prices for the foreign exchange market (technically, any other broker can be a source of prices), but on the other hand, it is difficult to find high-quality and adequate prices, especially if you are a beginner. There are companies in England, Denmark, Cyprus and other European countries that provide a similar service, focusing specifically on institutional clients. You will not find their advertisements on the Internet, they do not attract individuals. They work with smaller brokers like the one you want to create.

These companies will give you the liquidity that you provide to your clients by adding your own commission (the source of your earnings), you just need to agree on the terms.

You tell me, what about quotes from banks? Yes, you can get them too, but so that the J.P. Morgan let you in, you need to have at least $ 10 million on the company’s account. That is why this approach is not considered in this article. Moreover, the previously mentioned prime brokers already combine prices from dozens of large banks, therefore, at the initial stage, it is better to pay them a commission for a good service than to build the entire structure from scratch, being a startup.

WhiteLabelsFX provides prices for FREE!

We will assume that the first question has been resolved.

Let’s move on to the trading platform.

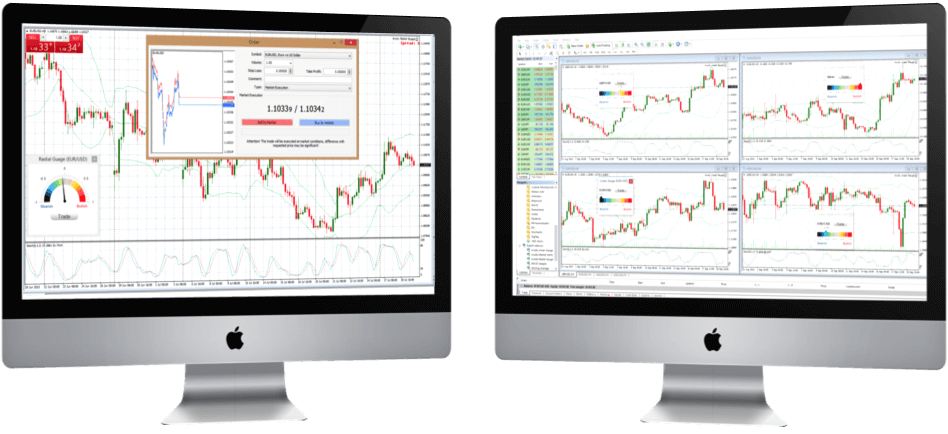

There are many trading platforms in the foreign exchange market PRO-Trader, Saxo-Trader, Rumus and others. But the greatest among them is the MetaTrader 4 platform. In this terminal it is convenient for the user to carry out graphical analysis, it implements one-click trading and dragging orders right on the chart. The most important thing in it is the presence of the built-in and most importantly popular programming language MQL. By visiting the MQL community site, you will find an impressive library of source codes for indicators, advisors (trading robots), and various scripts. There you can always immediately hire a freelance programmer to implement your ideas.

The big advantage of this platform is that it implements auto-follow signals that unite traders from different brokers and, despite the fact that people work with different companies, they can connect to the signals of absolutely any trader-manager. This gives customers a convenient popular service that allows them to earn money, and the company – an increase in turnover and customer loyalty. And the best part is that the function in the terminal is available to everyone and for free.

Therefore, I strongly recommend starting with MetaTrader 4. As you grow and the need arises, you can introduce other platforms, but MT4 is enough to start and long-term reliable operation.

With technology, it is more or less clear. Let’s move on to organizational and legal issues.

Which jurisdiction for the company to choose?

The jurisdiction of the company affects the entire business, from the ability to buy or rent a terminal, to the right to advertise.

There are essentially three options.

The first is to get a license in one of the European countries.

This will allow you to open an account for a company in any bank, receive a White Label from prime brokers (so as not to buy the entire terminal) and advertise services in the EU.

In terms of cost, this is the most expensive way, because you will need:

– Physical offices

– Employees with local government securities commission certificates

– Payment of contributions to insurance funds

– Payment of auditors

– Payment for license renewal and much more.

Here costs start at 200,000 euros one-time and monthly costs for employees and audit.

In terms of time, such a process from the start of collecting documents to actually obtaining a license will take a year at best, but most likely longer.

The second is to get a license in one of the non-European countries (for example, Vanuatu) and work with it. Here you no longer need an office and employees on site. You only need to renew the license. Such jurisdictions will cost from 20,000 euros one-time and 5,000-10,000 euros each year. The presence of such a license will make the company more presentable in comparison with an unlicensed one, but in general everyone understands that this is not Europe. With a bank account for a company, everything is more or less simple, since there is no one, but there is a license. But most likely UBS will turn you down. Obtaining such a license will take 6 to 12 months.

The third is to work without a license, as in fact most brokers. The lack of a license does not mean that the company is bad. There are many companies that operate from the territory of Saint Vincent, Seychelles and other unregulated jurisdictions quite successfully and the clients are satisfied.

It is important to simply understand that if you are going to work honestly with a client – the license will be a plus, but not decisive, and if you are going to make a pyramid – with or without a license – the clients will understand and run away. The option of a company without a license is the cheapest. It is most difficult to open an account for such a company in Europe. However, if you fully disclose the composition of the company, demonstrate that you work honestly, you will find a number of banks that will meet you halfway. In time, this option will take from a month to two. With this structure, you will also find companies that can give you a White Label.

In general, the third option is suitable for starting – starting work without a license. You will be able to open a company, an account and get started with minimal costs. Gradually, when you see the first results of the work, you can initiate obtaining a license in one of the European countries.

We’re done with jurisdictions and banks.

Let’s move on to payment systems.

In order for your future customers to be able to replenish accounts and withdraw their funds, you need to connect various payment methods. Everyone knows WebMoney, Skrill, Qiwi and other electronic payment systems. Naturally, you need a direct bank transfer and plastic.

What trading conditions should you give to clients?

Traditionally, companies have several types of trading accounts. The so-called “standard”, “VIP”, sometimes there are intermediate types of accounts.

The standard, as a rule, is the most common type of account, there they do not make minimum requirements for a deposit, but they do a slightly higher commission per turnover. For a client who is not involved in scalping, it is imperceptible, and the working conditions will completely satisfy him.

VIP – for clients already with serious amounts – 30-50 thousand dollars. There is a much lower commission, sometimes the commission for depositing and withdrawing funds is also compensated, preferential conversion rates are given.

The commission settings themselves will be tied to the prices of your liquidity source and the general market conditions. On the one hand, you must make money, on the other hand, the conditions for the client must be at least as good as, if not better, than those of competitors. Therefore, when choosing a source of liquidity, you need to especially carefully check the commission of your prime broker for each currency pair and bargain.

Setting up the price flow in the case of MT4 will take no more than one day, taking into account all checks. The interface is intuitive and the terminal is reliable.

Now we turn to the most important question.

How to attract customers?

Let’s point out for a point of reference that:

Your company is not licensed in Europe, we use the MT4 terminal.

With this approach, we immediately exclude the possibility of direct advertising of Forex services in the EU. The rest of the advertising is not prohibited.

Naturally, you need to start with the company’s website. On the one hand, the site should be original and recognizable, on the other, it should not be a “spaceship”, everything should be clear and simple. Naturally, the site should also have some kind of knowledge base that will answer most of the customers’ questions and help in promoting the site in search engines.

Your site itself may be quite light in terms of logic, but the personal account of the site is a completely different story. In addition to being recognizable, it should be simple and intuitive, because it is here that the client will create accounts, make deposits and transfers, that is, work with money outside of trading. And here everything should be clear and simple, while implementing all the business logic of the client’s work with the company and the market.

In order to immediately avoid standard mistakes, you can order an audit of a website prototype from professional CEO-managers in the financial sector in order to get expert opinion and help in representing the face of your company.

It will be useful to maintain groups in social networks and branches in specialized forums (somewhere they will be allowed to give direct advertising, somewhere only information about the company and news, somewhere analytics). This will give you an additional source of leads, and your customers an additional channel of company feedback. Naturally, this will raise the “noise level” around the company.

It’s also a good idea to involve bloggers and CPA networks (affiliate programs).

All this will not give you an instant arrival of customers, but, it will start to create a “noise” around the company, will begin to increase its citation rate, and this, in turn, will increase you in the search engine results and increase the confidence of potential customers.

We won’t even talk about calls to clients and mailing. If you have legally collected data – of course, you need to organize it.

Let’s summarize all of the above. To start your own forex broker, it will be enough:

– A company in an unregulated country.

– Receiving the price stream and the MT4 trading platform from a prime broker using the White Label scheme.

– Organization of accepting payments and payments through an aggregator – only integration costs, as a rule, no setting commissions.

– Implementation of the company’s website and personal account with integration to the trading platform, with a back office.

– Attracting customers – (includes calling, mailing, maintaining groups in social networks and forums, blogs, contextual advertising).

This, I remind you, is the most minimal option, in fact, the developed site will need to be “finished” and maintained. You will then need to arrange for technical support. Not to mention the fact that you will not launch a project in one day and you need to pay for the work of people who raise the project, there are also additional costs. However, these are not the biggest costs compared to starting other mid-sized businesses. And with proper promotion and correct work, it will be possible to return the investment pretty quickly.

How does the white label from WhiteLabelsFX differ from others?

1. You don’t pay any commissions, only monthly payments.

2. We do not require any documents, your first payment is a confirmation of your serious interest in us.

3. There are no restrictions.

4. No character restrictions.

5. The cost of the server is already included in the price.

6.No hidden fees!

7. We can offer you a choice either Metatrader 4 and Metatrader5

8. User migration cost $ 0

9. Free MT4 MT5 API

10. Free data price feed

In general, I can say that nothing is impossible in this task. There are examples of brokers consisting of two people in general – they organized the White Label, both employees and founders, and programmers, and support. And they work successfully. So go for it!