Brokerage account: what is it?

You can’t directly trade on the exchange – for any transactions, including investments, purchase and sale of securities, options and futures, intermediaries are required. Their role is played by brokers – companies with special licenses from the Central Bank. It is brokers who open accounts for individuals and legal entities and allow you to earn money on exchange fluctuations.

A brokerage account can be compared to a wallet where money and valuables are stored. The broker opens the wallet on behalf of the owner and conducts operations on foreign exchanges. A regular bank account is not suitable in this case – for exchange operations you need a separate “wallet”.

The principle of the brokerage account is as follows:

– The client enters into an agreement with a brokerage company for opening and brokerage account servicing, after which he deposits a certain amount of money.

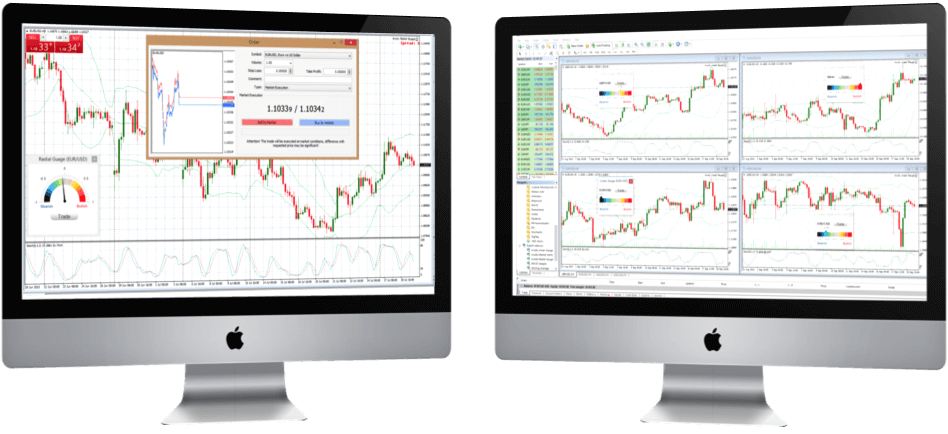

– To manage the account, the client is given an electronic tool – a program for a PC or an application for a smartphone.

– If you need to perform an operation, the client sends the appropriate order to the broker (by phone).

– The broker confirms the operation, after which the funds are debited or credited (minus the commission fee), the composition of the client’s financial assets changes.

Brokerage accounts can be classified depending on the types of operations and the form of cooperation between the client and the company:

– cash – a popular option because of its simplicity, in which the first transactions can be made immediately after crediting funds to the deposit;

– individual investment account (IIA) – allows you to receive an annual tax deduction;

– margin – provides access to other brokerage services (for example, lending for conducting trading operations in the stock markets);

– optional – provides an opportunity to purchase and sell options.

Features of using a brokerage account

A brokerage account allows you to invest money in securities (stocks, bonds, etc.) and earn money on it. Profitability on a brokerage account is often higher than on traditional deposits with banks, but the risks are also higher. It should be remembered that in exchange transactions, the client takes responsibility for good luck and failure. The broker only executes orders, therefore, can not affect the profitability or loss-making of transactions.

How to make money with a working brokerage account?

Suppose an investor (that is, the owner of a brokerage account) acquires Google shares for a certain amount. Now, as a shareholder, he has the right to receive remuneration (dividends), if this is provided for by the charter of the company. When stocks rise in price, they can be sold profitably and receive income from the difference in past and present value.

People whose profession has become trading in the securities market are called traders. They are not interested in increasing capital through thoughtful investments, but prefer to receive income from fluctuations in the value of assets.

Investors, on the contrary, consider the acquisition of securities as long-term investments. For them, buying stocks or bonds is another source of income (often passive). They have only one thing in common with traders – a brokerage account, without which securities transactions are not available.

Benefits of a brokerage account for individuals

Today, the topic of brokerage accounts is especially popular. Regular deposits, despite the high level of financial security, almost do not bring real income. Therefore, ordinary citizens are interested in looking towards investment through brokerage services. What are their advantages?

– You can acquire securities of leading foreign companies, as well as large domestic giants. Shares allow you to receive dividends (passive income) or revenue by reselling at a higher price.

– Income from bank accounts is slightly higher than annual inflation in the Russian Federation. With proper use, a brokerage account allows you to achieve much more attractive indicators.

– Assets with high liquidity help to avoid problems associated with resale.

– The presence of shares of different companies guarantees a stable income.

The main difference between brokerage and bank accounts

The activities of any financial organizations, including banking and brokerage, are regulated by the Central Bank. Customers of these companies, in accordance with the law, should receive safe and reliable financial services. However, to achieve these goals, banks and brokers use completely different tools.

Broker account: how much are the services of a broker

All expenses associated with a brokerage account can be divided into the following categories:

– Fee for opening an account.

– Monthly fee in the absence of activity on the account.

– Commission for intermediary services in operations related to the purchase or sale of assets. Its size usually does not exceed tenths of a percent. However, brokers often introduce an increased commission for certain types of transactions. All these features should be clarified in advance, before signing an agreement to open a brokerage account.

– Commission for exchange services – the amount of remuneration is calculated on the basis of daily revenue.

– Commission for the storage, accounting and processing of financial assets – paid monthly

In addition, brokerage companies may charge for the use of programs and applications, as well as information and analytical tools.

Since the investor bears all the risks associated with financial transactions on a brokerage account, it is impossible to make money on securities without specialized knowledge. Success requires a balanced investment strategy.

Having a brokerage account, you can earn in the following ways:

– Acquire shares for dividends. For best results, it is recommended to buy securities of successful companies with high profitability.

– Upgrade game – the acquisition of shares at a low price for the purpose of subsequent resale at a high price. Transactions of this kind can be short-, medium- and long-term (depending on the speed of turnover of assets).

– Downgrade game – securities are borrowed from a broker and sold immediately. When the price falls, a reverse transaction is carried out – that is, the required number of shares is bought at a bargain price and returned to the broker. Profit in this case is the difference in the market value of the securities.

Despite the apparent simplicity of investment transactions, real income from the exchange can be obtained only with a balanced approach. Before buying or selling securities, you should carefully study the analytical calculations, take into account economic, geopolitical factors, as well as data from the financial statements of large companies, expert forecasts, etc.