Forex Leverage

WhiteLabelsFX Solution is a complete brokerage solution that provides our partners with the tools they need to help them take their business to the next level. Witha

Leverage is, in fact, borrowing capital in order to increase investment income. In the Forex market, a broker can “lend” capital to a trader, which allows the latter to open significantly larger positions, as if he has more significant capital on his trading account. However, this also means that the trader will incur losses in the same proportion, as if his capital was much larger.

Brokers can afford such operations, because their losses are limited by the size of the balance of the trading account of the trader. As soon as the loss reaches the amount of money in the account of the trader, the broker will close all of his current positions. This will prevent the trader from losing more funds than he has in his account, and he will not owe money to the broker.

How Forex Leverage Works

When a position is opened on the Forex market, the market moves either in the direction of the trader’s position or against it. Each point in the price movement corresponds to a fixed amount of capital, which is added or deducted from the balance of the trading account. If the market moves in the direction of the position of the trader, he makes money; if not, the trader suffers a loss.

Currency trading is carried out in the form of “contracts” for a certain number of so-called standard lots. Each lot is equivalent to 100,000 units of currency. If the US dollar is used as the quote currency and the trader opens a position for one standard lot, then he buys or sells 100,000 units of this currency.

Since the course of the currency price is measured in points – that is, a share of 0.0001 corresponds to each point – when trading a standard lot, each point costs $ 10 (0.0001 x $ 100.000 = $ 10). If the transaction brings 10 points of profit, then the trader earns $ 100. If the price goes 10 points in the opposite direction from the position, then the trader loses $ 100.

Not everyone has such capital that allows you to trade currency in the amount of $ 100,000, so you can use leverage, i.e. borrow money from a broker to make a deal for $ 100,000 in the absence of $ 100,000 in your trading account.

When using leverage when opening a position, you get borrowed capital, but this money does not actually come to your account. However, you see how the current result for an open position is changing, because now each point is more expensive, and price movement in one direction or another can potentially bring higher profits or losses.

Leverage requires a minimum balance

Typically, in order for a trader to borrow capital to increase the volume of a position, he himself needs to invest a small share as a security – it is called margin. In other words, in order to take advantage of the leverage of a broker in the Forex market, you first need to have a certain minimum amount in your account. This minimum capital in size will be different for different brokers.

Different brokers lend different amounts of money

Different brokers also offer different leverage, expressed in proportion, for example, 100: 1. This means that the amount borrowed to the trader is 100 times the balance of his trading account.

For example, if a broker offers a leverage of 100: 1, then a trader can purchase a standard lot, which is equivalent to $ 100,000 of currency, for only $ 1,000 – this $ 1,000 is margin.

This means that a trader can open a position at which each point will cost $ 10 and earn $ 100 in just 10 points of the price move, while having only $ 1,000 in his account instead of $ 100,000.

Maximum leverage

Maximum leverage is the maximum leverage available for use at a specific time. This limit is set by the broker. Some brokers can offer almost any leverage up to 500: 1, but a leverage of 100: 1, as a rule, is more than enough.

Forex Trading Hazards

Many newcomers make a mistake using leverage without taking into account the risk for each transaction and based only on the balance of the trading account. If the trader does not take into account such a risk, then the leverage can destroy the trading account.

Suppose a trader with a balance of $ 1.000 uses a leverage of 100: 1. This means that each point in the price move costs $ 10. Suppose that his stop loss is 10 points from the position’s open price. If the stop loss is triggered, the trader will lose $ 100 – 10% of the total account balance, which significantly exceeds the minimum acceptable level, according to our money management principles.

Risk Mitigation Through Money Management

If you apply the right principles of money management, then the amount of leverage will not matter to you.

What is the reason? Traders calculate their risk as a percentage of the total balance. In other words, the total amount of risk on the transaction, even if there is leverage, will be less than 2%.

Suppose that the same trader has the balance of $ 1.000 and the same stop loss of 10 points. However, instead of leverage of 100: 1, where each point costs $ 10, he uses leverage 10: 1, where each point costs $ 1.

Now, if the price goes 10 points in the opposite direction, the loss will be only $ 10 – only 1% of the balance on the trading account.

Using money management and taking into account the risk of the transaction, you can safely use leverage, because even with it, you will risk no more than 2% of trading capital.

The impact of leverage on operating costs

Leverage also affects the value of Forex trading, because for each transaction you need to pay a certain amount. Costs appear either in the spread or in the broker’s commissions. The higher the leverage, the higher these costs. The higher the costs, the more profit you need to cover them.

Here is a good example:

The trader opens an account for $ 10,000 and decides to buy 10 standard lots of the EUR / USD pair with a spread of 2.5 points.

Leverage of 100: 1 is used ($ 10 per point x 2.5 points of spread x 10 lots). This means that in this particular transaction, the cost of each lot is $ 25, and the trader immediately buys 10 lots.

Transaction costs appear in the spread, i.e. we pay $ 250 for all 10 lots, which already at the entrance to the transaction corresponds to 2.5% of the balance in the account – this is even before we determine the overall risk of the transaction. The trader should receive 2.5% of the profit in order to only cover the costs at the time of opening the position.

This is completely unacceptable, and for this reason, traders who use high leverage without taking risks into account under the rules of money management quickly lose all trading capital.

Compare this with another example where a trader uses a leverage of 10: 1, and each point costs $ 1. The cost of each position is $ 2.5 ($ 1 per point x 2.5 point spread x 10). This means that the amount of transaction costs will be $ 25.

This is a more acceptable value, which is fully consistent with the principles of money management.

Findings:

– leverage is the borrowing of capital in order to increase profits;

– Forex trading is carried out under contracts called “lots”;

– the standard lot is 100,000 currency units, i.e. when using the US dollar as a quote currency, each point in the price movement will cost $ 10;

– in order to use the leverage of the broker, the trader must keep some minimum capital in his account – it is called margin;

– various brokers offer different leverage, with the most common leverage being 100: 1, i.e. a trader can buy a standard lot for only $ 1,000;

– when traders use leverage, forgetting about money management, they risk losing all their trading capital;

– leverage increases transaction costs for each transaction.

our innovative technology and fully customizable resources, WhiteLabelsFX’s Binary Options Gray Label Solution can be tailored to the specific needs of all financial institutions.

Our experienced Binary Options Gray Label team will guide you from the start until your business goals are met. You will be provided with a dedicated account manager who will be available for support and guidance with whatever resources you need to build your business along the WhiteLabelsFX journey. You will receive guidance on marketing strategies, system and platform implementation, and sales and customer service.

Minimize your risk, cost and time by getting started and using the Gray label solution for WhiteLabelsFX. Access our long-term liquidity tools and technologies and enjoy the great benefits that come with partnering with a trusted brand like WhiteLabelsFX.

Key feature:

– Access to deep liquidity and market-leading spreads

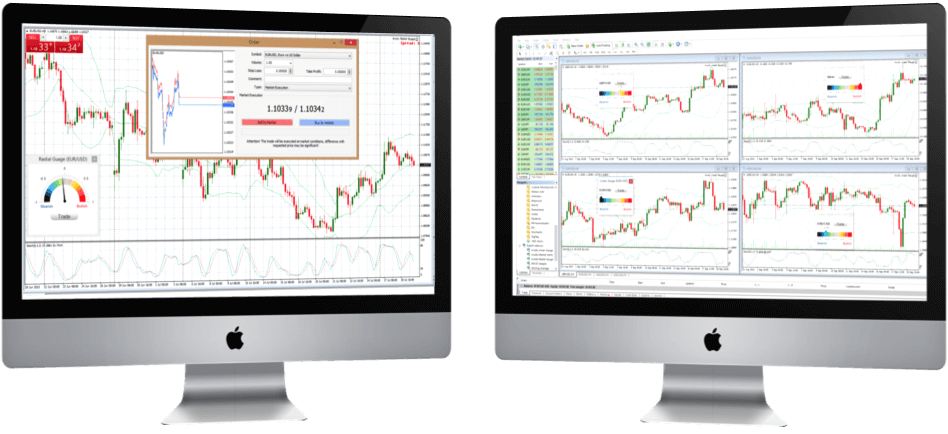

– Proprietary MetaTrader 4 or MetaTrader 5 platform

– Innovative and trustworthy trading technology

– 24/5 Trade and support

– Individual risk management, pricing options and execution

– Sales conversion tools

Find out more information and requirements for this solution by filling out the form and one of our Binary Options Gray Label special agents will contact you to assist you.